Effects of Changing Tax Policy on Commercial Real Estate

By Lee & Associates

In its “American Family Plan,” the Biden administration proposes to nearly double the capital gains tax for people who make more than $1 million a year. The plan will tax capital gains at the same rate wages and salaries are taxed and raise the top marginal income tax rate from 37% to 39.6% for households making $400,000 or more in income. If passed, these taxes will have significant ramifications on the US economy in general and on commercial real estate in particular. This report will examine the tax implications of various aspects of the “American Family Plan.”

CAPITAL GAINS TAX INCREASES

Currently, the top tax rate on capital gains, which applies to higher-income earners, is 20%. President Biden would increase the capital gains rate for those with incomes of over $1 million per year to the top rate on ordinary income, which under his plan would increase to 39.6%. If you include the current 3.8% net investment income tax that is imposed on those earning more than $200,000 annually ($250,000 for married couples), then the increase would be from 23.8% to 43.4%, an almost doubling of the capital gains tax rate for high-income investors.

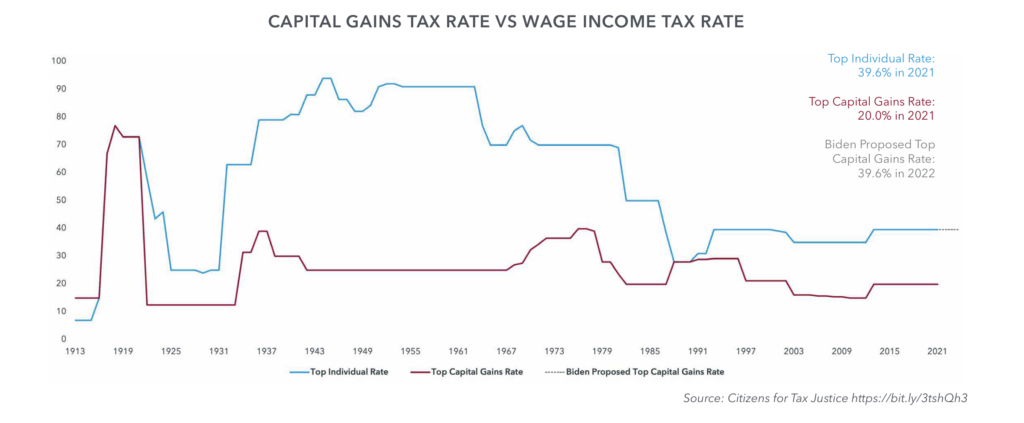

For historical perspective, when the modern income tax was created in 1913, capital gains were taxed at the same rates as ordinary income — as high as 77% in 1918–the year World War I ended.After the war, Congress lowered the top individual tax rate to 58% in 1922 and split off capital gains from regular income, slashing the rate to 12.5%.

Since then, capital gains rates have been changed frequently, climbing as high as 40% but typically remaining much lower than the top rate on ordinary income. The capital-gain-tax rate is currently 20% on incomes over $441,450 and 15% on incomes from $40,001 to $441,450. There is no capital gains tax on income of $40,000 or less.1

The top marginal tax rate on capital gains has historically been much lower than that for ordinary income, although the gap has narrowed as overall tax rates have come down. The Biden administration’s proposal would eliminate the gap entirely.2

TAXING CARRIED INTERESTS AS ORDINARY INCOME

In private equity investments, carried interest is the fund manager’s share of the profits when the profits are realized, and it amounts to the bulk of a fund managers’ compensation. It is designed to align the manager’s interests with the investor’s and to incentivize performance.

Under the current tax code, carried interest is considered a return on investment, so it is taxed at the 20% capital gains rate rather than the 37% regular income tax rate, for those who make over $1 million.Biden’s proposal would tax them as ordinary income, effectively raising rates on many real estate entrepreneurs from 20% to 39.6% for those earning more than $1 million.

Moreover, the “American Families Plan” would also eliminate the step-up in basis for properties and other assets that are inherited. Currently, the basis on a property that is passed on to heirs is stepped up to fair market value at the time of death. The heirs, therefore, pay no tax on any appreciation in value since the asset was purchased because, technically, there is no gain. Take, for example, a property purchased at $1 million that was worth $10 million at the time of inheritance. Under the change, the estate would have to pay capital gains tax on the $9 million gain.3

INCREASED TAXES ON PASS-THROUGH ENTITIES

Biden would repeal the current 20% deduction for qualified business income earned by partnerships, limited liability companies, sole proprietorships, and other so-called “pass-through” entities, for taxpayers earning over $400,000 per year (Section 199A). Income earned by these entities would generally be taxed at the ordinary income rate (currently 37%). The 20% deduction effectively makes income earned through pass-throughs taxable at a 29.6% rate.4

1031 EXCHANGES

1031 exchanges are used in all property types and across the real estate investor universe. The Biden administration is asking Congress to enact legislation that would disallow 1031 exchanges for gains greater than $500,000.

For example, without the 1031 exchange option, someone who buys a property for $5 million and sells it for $15 million no longer has $15 million to reinvest. Instead, that investor will be paying 40 percent federal tax plus other taxes that could add up to 50 percent of the gains from the sale. Assuming a 50% tax liability on the gains, that would leave them only $10 million to reinvest.

According to most tax specialists, if Congress moves to limit 1031 exchanges, there is likely to be an initial rush to sell properties held in 1031 before the change takes effect. A drop will presumably follow that in the number of property sales transactions and less liquidity in the market.

Sources: 1 Marketwatch.com https://on.mktw.net/3up3O0M2 Theconversation.com https://bit.ly/3efOGNw 3 Cpexecutive.com https://bit.ly/3b2grY9 and WSJ: https://on.wsj.com/33fxPEm4 NAIOP: https://bit.ly/3nYKUM1

The information and details contained herein have been obtained from third-party sources believed to be reliable, however, Lee & Associates has not independently verified its accuracy. Lee & Associates makes no representations, guarantees, or express or implied warranties of any kind regarding the accuracy or completeness of the information and details provided herein, including but not limited to, the implied warranty of suitability and fitness for a particular purpose. Interested parties should perform their own due diligence regarding the accuracy of the information. The information provided herein, including any sale or lease terms, is being provided subject to errors, omissions, changes of price or conditions, prior sale or lease, and withdrawal without notice. Third-party data sources: The sources listed above, CoStar Group, Inc., and Lee & Associates proprietary data. © Copyright 2021 Lee & Associates all rights reserved.