INDUSTRIAL OVERVIEW: CONSTRUCTION SETS RECORD, GROWTH CONTINUES

Strong tenant expansion continued in the first quarter as developers were underway on a historic volume of new projects while the pace of rent increases downshifted slightly. Net absorption totaled 73,987,060 SF in the first quarter, bringing the aggregate for the last four quarters since the lockdown to 252.3 million SF the most since 2017. Vacancy is projected to remain between 5% and 6%, roughly half of the level reached following the global financial crisis. Despite the uncertainty over the strength of an economic recovery that is expected to start later this year, a wide range of companies are investing heavily in their logistics networks as they plan for post-Covid growth.

After taking a hiatus in the first half of last year, construction starts currently total nearly 330 million SF. The skyrocketing Q1 development activity follows a flat first half and a second half in which 160 million SF broke ground. Investor interest in industrial’s stability and outlook dampened somewhat. The $93 billion in 2020 transaction activity was 20% less than 2019. After enjoying nine years of rent growth in excess of 4% the pace downshifted to 3.2% last year as rising completions and vacancy hindered growth. But the national total masks variations across markets and submarkets. Worchester, Massachusetts; Grand Rapids, Michigan; Nashville, Philadelphia, Sacramento and Salt Lake City rank among the strong rent growth markets. Meanwhile, rent growth has slowed the most in Pittsburgh, Minneapolis, Sandusky, Ohio; Rockford, Illinois; and Houston, where the 12-month average fell 0.9%.

Institutional investors and REITs, which continue to be attracted to industrial property’s steady

performance, were the only net buyers for the year. Private sellers and owner/users registered as net

sellers with sale-leasebacks gaining prevalence as they provided merchants with capital and investors

with a long-term tenant. Moderating transaction activity and rent growth cooled industrial price growth

to 4.3% year over year.

Amazon aggressively expanded its network in 2020, leasing more than 82 million SF, a 183% increase

over its 2019 growth of 29 million SF. The company accounted for about 10% of total leasing volume.

Several of Amazon’s recent leases have been in Midwestern markets, including two warehouses totaling

2.2 million in Columbus, Ohio. The company announced plans for a four-story fulfillment center with a

700,000-SF footprint in a suburb south of Omaha, Nebraska. The facility reportedly will cost $227 million

and is expected to create 1,000 jobs. Other major users with recent expansions include Home Depot,

Lowe’s and other home improvement merchants. By the end of the year Lowe’s will have delivered

50 cross-dock terminals, seven bulk distribution centers and four e-commerce fulfillment centers –

completing an 18-month initiative it announced last August.

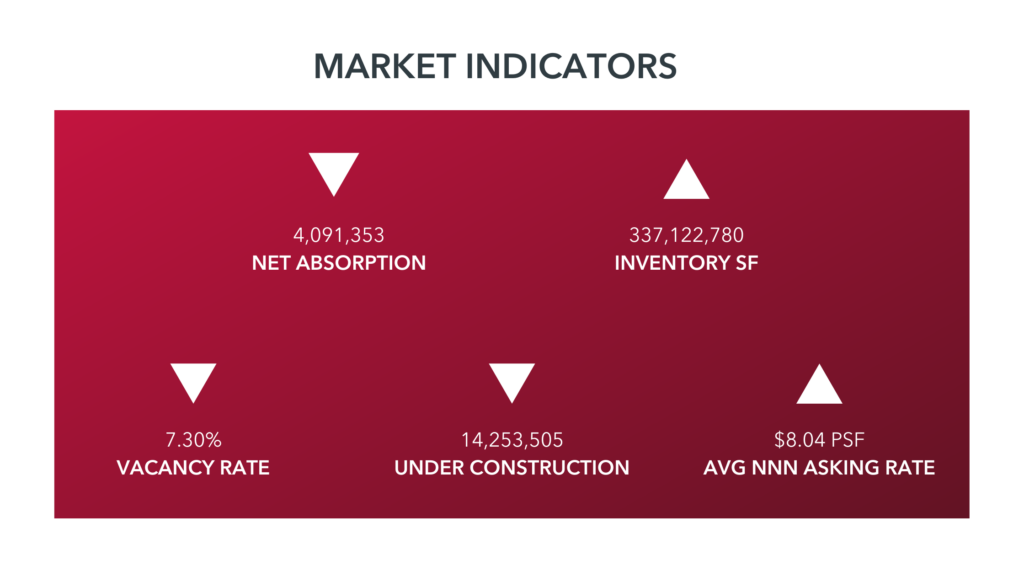

PHOENIX INDUSTRIAL OVERVIEW

The Phoenix Industrial Market continued on a record trajectory through Q1 posting

over four million feet of positive net absorption. Construction numbers remained at an

all time high as new companies and developers see Phoenix as a top industrial market

for growth and new opportunities. Lease rates continued to rise at an equal pace to

an average of $0.67 NNN across all product types valley-wide. The overall vacancy fell

from 7.7% to 7.3%. The Metro Phoenix Industrial Market will continue to thrive as the

rapid acceleration of e-commerce sees major online retailers taking large blocks of

space to keep up with the surge in demand. Phoenix, with its low cost of living, large

employment pool, and pro-business environment is poised to capitalize.